Use the

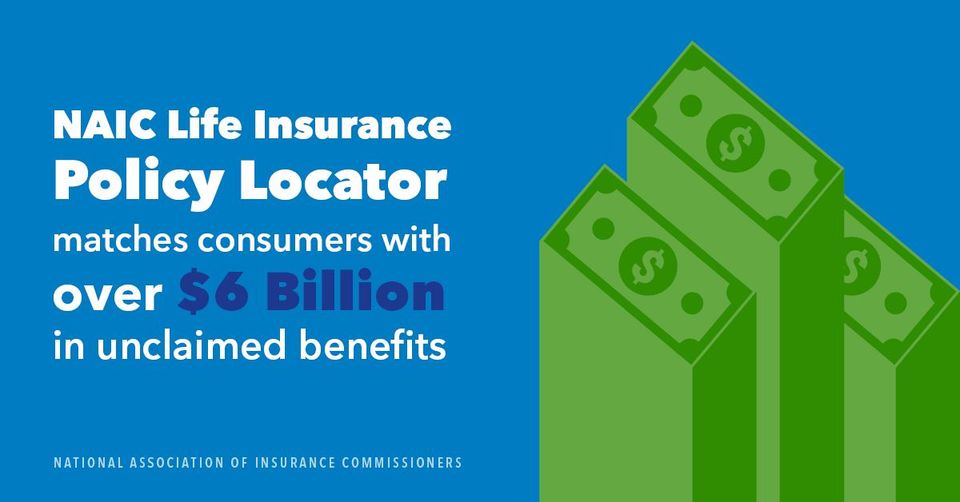

Life Insurance Policy Locator to help located life insurance policies and annuity contracts of a deceased family member or close relationship:

Click

here to watch recorded webinars or video content:

To learn more about our consumer education and advocacy initiatives, read our Consumer Publications. These materials provide information about most types of insurance from auto, homeowners, health and life policies to annuities, title insurance and coverage for boats.

If your community group, HOA or organization is interested in a virtual or in-person presentation or speaker, contact Associate Commissioner Patricia Dorn at patricia.[email protected] or click here.