Do you need homeowners insurance?

Most people do not think about homeowners insurance until they have reason to use it. Although we know that fires, thefts and accidents occur, we tend to think “that will never happen to me.” But the odds are that you are more likely than not to experience a fire, theft, accident or other loss that may be covered by homeowners insurance. Purchasing homeowners insurance will not prevent fires, thefts or some other types of loss, but it can help you recover from the financial effects of a loss that is covered by your policy.

A homeowners policy may also protect you if someone is hurt or has their property damaged because of something you do or if something that you own hurts someone else or damages their property. If you have borrowed money to purchase your home, you may also need insurance to protect your lender. Most mortgage holders require you to have homeowners insurance, and that the policy name the mortgage holder as an “additional insured” under the policy in order to protect their financial interest in your home. However, even if you do not have a mortgage on your home, you may still want to purchase a homeowners insurance policy to protect you from financial harm in the event of a covered loss. Whether you live on a farm, own a condominium, home or mobile home, your home and its contents are probably your largest and most important investment. A homeowners policy will help you protect your investment.

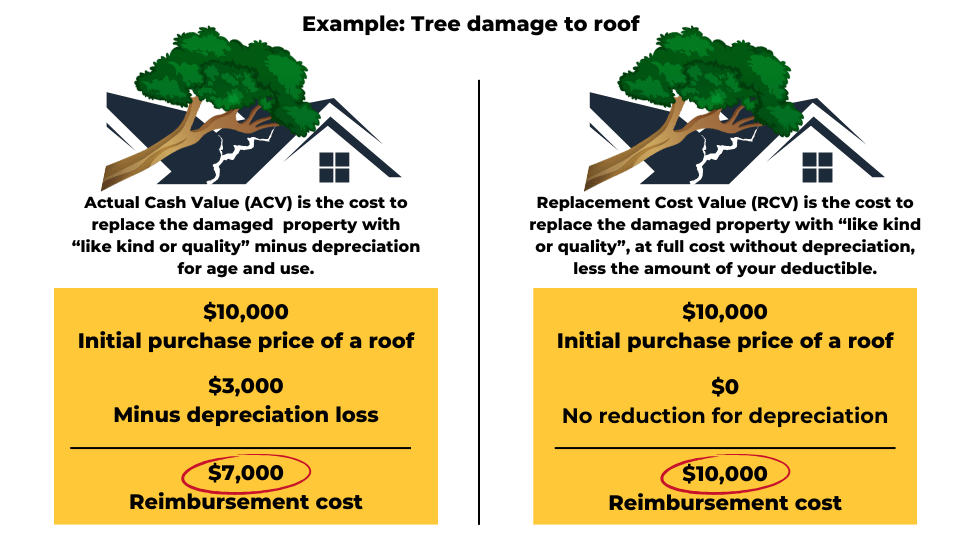

Know the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV)

Homeowners insurance may provide Replacement Cost Value (RCV) coverage or Actual Cash Value (ACV) coverage. If you have RCV coverage, when you have a covered loss, your policy will pay (up to the policy limits) the cost to repair or replace your damaged property without deducting for depreciation. If you have ACV coverage, when you have a covered loss, your policy will pay (up to the policy limits) the depreciated cost to repair or replace your damaged property.

The amount deducted for depreciation may be significant, especially if the damaged property was at or near the end of its useful life. For example, if your 20-year-old roof is destroyed by a covered cause of loss and must be replaced, a policy that provides for ACV settlements may pay as little as twenty percent of the cost to replace the roof, since the useful life of a roof is generally considered to be 25 years.

Under an RCV or ACV policy, the payment for the damage to the structure is paid under your dwelling coverage and is subject to the policy limit. You should check the declarations page of your homeowners policy to see whether the policy provides RCV coverage. If it does not specify “replacement cost”, then your policy may only cover ACV. If it specifies replacement cost, then you have RCV coverage.

Even if you have purchased an RCV policy, you still must read the policy to determine if there are any provisions that limit payment for damage to certain surfaces, such as roofs, to ACV. You also can call your insurer or insurance producer (agent or broker) to determine what type of coverage you have. Depending upon the language of your policy, when you present a claim for a covered loss under an RCV policy, the insurer initially may pay only the ACV for your damage; however, once you present evidence that the damaged property has been repaired or replaced, the insurer will pay the difference (referred to as “recoverable depreciation”) up to the replacement cost.

Factors affecting your homeowners insurance premium

When you apply for homeowners insurance, insurers evaluate your risk and the likelihood that you will file a claim. Once your level of risk has been determined, the insurer will group you with policyholders that have similar risk characteristics. Then the insurer will assign a rate based on the claims history for your risk group. Some of the factors that may be considered are:

-

Prior claims. Whether you or your property have had any prior claims under a homeowners insurance policy (even if at the time of the prior loss you were not the owner of the property), or if it is a new policy, under your automobile insurance policy, the date(s) of any prior claims, the nature of the claim(s) and the amounts paid by insurance for each claim. An insurer may not classify or maintain an insured for a period longer than three years in a classification that entails a higher premium because of a specific claim.

-

The type of construction. Frame houses usually cost more to insure than brick houses.

-

The age of the house. Newer homes are usually less expensive to insure than older homes.

-

Access to and the quality of local fire protection. The distance between your home and a fire hydrant, as well as the capability of your local fire department, determines your “fire protection class.” Fire protection classes generally are used by insurers to either increase or decrease someone’s premium.

-

The amount of coverage. The dollar limits (the amount of coverage) of your policy will affect the amount of the premium. Generally, the higher the limits, the higher the premium.

-

The amount of coverage required by a lender. Remember that your mortgage includes the value of your land; your homeowners insurance only insures the buildings on your property and the contents of those buildings, not your land. Under Maryland law, your lender may not require you to insure any real property in an amount that exceeds the replacement cost of the dwelling. The lender is also not legally allowed to obtain insurance in the amount of the loan if the loan amount exceeds the replacement cost of your home.

If your lender requires you to purchase an insurance policy in excess of the amount it will cost to replace your home, you may file a complaint with the Commissioner of Financial Regulation at 410-230-6077 or with the Maryland Insurance Administration, who will forward such a complaint to the appropriate enforcement agency.

Visit: https://www.labor.maryland.gov/finance/consumers/comphow.shtml

Email: [email protected]

-

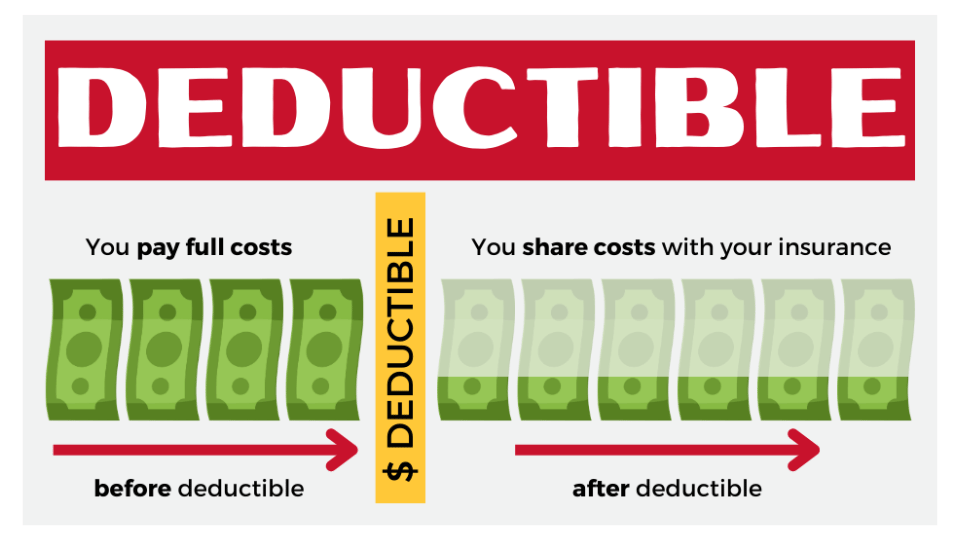

The amount of the deductible. The deductible is the amount you will pay in the event that you have a covered claim; the insurer’s payment to you will be reduced by the amount of the deductible. Since the deductible reduces the amount of money that an insurer pays on a claim, generally the higher the deductible, the lower the premium.

-

Discounts. Some insurers offer discounts on policy premiums, if for example, you purchase multiple policies (e.g. home and car), and/or install deadbolt locks or alarm systems in your home. Since discounts may vary from insurer to insurer, it is a good idea to ask what discounts are offered.

Considering purchasing flood insurance?

Flood Insurance is

NOT covered under most homeowners policies. Flood insurance may be available as an endorsement to your homeowners or condominium insurance policy, or as a separate policy. While some insurers offer flood policies, flood insurance can also be purchased from the National Flood Insurance Program (NFIP). For information, contact your insurer, insurance producer, or

visit our website for more information on Flood Insurance.

When shopping for your homeowners policy, it is a good idea to:

Make sure your dwelling policy limits are at least 80% of the replacement cost of your home or more if required by your insurance policy.

Ask if you should list and separately insure valuable items of personal property on a personal property schedule.

Ask about additional coverages like water/sewer backup, and ordinance or law coverage.

Choose the best deductible for you, and make sure you understand the difference between flat and percentage deductibles.

Look for language in your policy about vacant or unoccupied property. Some policies have language that may prevent receiving payment for a claim if the property is left vacant or unoccupied.

Read your policy for clauses such as an “anti-concurrent causation” clause. Damages incurred by a combination of covered and non-covered perils are typically not covered.

Creating a home inventory list

A home inventory list is a list created by the homeowner documenting items in their residence and the value of the items. A home inventory can be a useful tool. When shopping for insurance, it can help you determine the best insurance coverage for your personal property, and in the event of a covered loss, may be used to identify your personal property that is lost or damaged and its value(s).

It is a good idea to update your inventory list once a year, or anytime you purchase something of value. In addition to making a list, you can photograph and/or video each room and the exterior of your home. Since an inventory list or photographs could be damaged or destroyed if your house is damaged, for example, by a fire, you may want to store your inventory list, photographs and/or video in a safe place, like a bank safety deposit box or fire proof safe, together with your home insurance policy and receipts you have. If you have access to a scanner or have created your inventory list digitally, you may also be able to store it in the cloud. You can use the free home inventory tool to start your list.