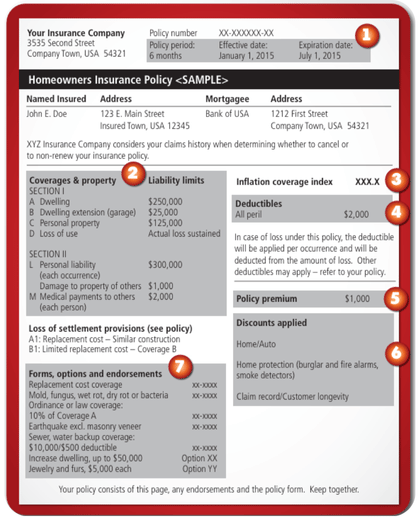

When you receive a copy of your homeowners insurance policy - whether for the first time or at renewal – you will see a lot of different documents. Some will be forms that are part of the actual policy itself and describe what is or is not covered. Others will be legal notices required by law. In addition to these documents, you will also find a Declarations Page (dec page). The dec page - which is often within the first few pages of the package– is the part of your policy that is specific to you and provides important information about your policy limits for each type of coverage.

The declaration page will show the name of the insurer and the name of your insurance producer (agent or broker), the insured’s name(s), and the address of the insured location. It may also list your mortgage company, if there is one, as an “additional insured”. It is important to be sure that all of the information listed on the dec page is correct. If you have refinanced, your mortgage was sold, or you have paid off your mortgage and this information is incorrect, it is very important that you notify your insurer so this may be corrected. If there is a claim, generally the mortgage company will be included on any settlement checks if it is listed as an additional insured on the policy.

The dec page will also list your coverage amounts and the premium associated with each. The first coverage listed is typically Coverage A – Dwelling. This amount is the estimated cost to rebuild your home if it is considered to be a total loss caused by a covered peril or cause of loss. This is not always the real estate value.

To make sure your home is properly insured, contact your insurer or insurance producer, who can run a replacement cost calculation and give you a quote for actual cash value coverage versus replacement cost value coverage. To learn more about ACV versus RCV, please see the Maryland Insurance Administration’s brochure, Consumer Guide to Homeowners Insurance.

The declaration page will also list your coverage amounts for:

The declaration page will also list your coverage amounts for:

- Coverage B – Other Structures, which generally provides coverage for structures that are not a part of the house such as a stand-alone garage, shed, fence, etc.;

- Coverage C – Personal Property, which generally provides coverage for loss or damage due to a covered peril to personal property, such as clothing and furniture; and

- Coverage D – Loss of use, which generally provides coverage for additional living expenses if your home is unlivable as a result of a covered loss.

The amounts of each of these coverages will usually be based upon a percentage of that Coverage A. You will need to read the policy forms though to understand what is and what is not covered under each type of coverage for your policy.

The next coverages shown on the declaration page will generally be liability coverage and medical payments to others. While the terms of the policy will define the scope of these coverages, generally liability coverage protects you in case someone is injured on your property as a result of negligence on your part. Liability coverage generally pays for attorney’s fees and any settlement amount up to policy limits which are indicated on the dec page. Medical payments to others generally pay medical costs for injuries sustained while someone is on your property, without the need to file suit, up to policy limits state on the dec page. This coverage generally does not apply to anyone living at the insured location.

The declaration page will also indicate the policy deductible(s). There are three different types of deductibles. The first type is a flat, all peril deductible. This will be a set amount that you, the policyholder, will pay out of pocket before there is any payment under your policy. This amount is a set dollar amount, such as $1,000, $2,000, etc. The second type is a percentage deductible. This is a percentage of the amount of your dwelling coverage (the Coverage A policy limits shown on the dec page), not a percentage of the claim. For example, if the Coverage A policy limits amount is $200,000 and the deductible is 5%, the deductible would be $10,000. The third type of deductible is a combination of the first two. Some policies have a percentage deductible for a specific cause of loss, like damage caused by a wind storm, and a flat deductible for all other covered perils like a fire.

Finally, the dec page will list any endorsements, like water/sewer backup coverage, ordinance and law coverage, mold coverage and replacement cost coverage that may be included in the policy. The amount of the coverage limits will be listed as well. But to understand the terms of coverage for these additional protections, and any others listed on the dec page, you would need to read the forms and endorsement(s) provided with your policy.

It is very important that you review the Declarations Page as soon as you get it to be sure it is correct and that you know what your policy will cover. If you see any incorrect or missing information, you should contact your insurer or insurance producer immediately.